Summary

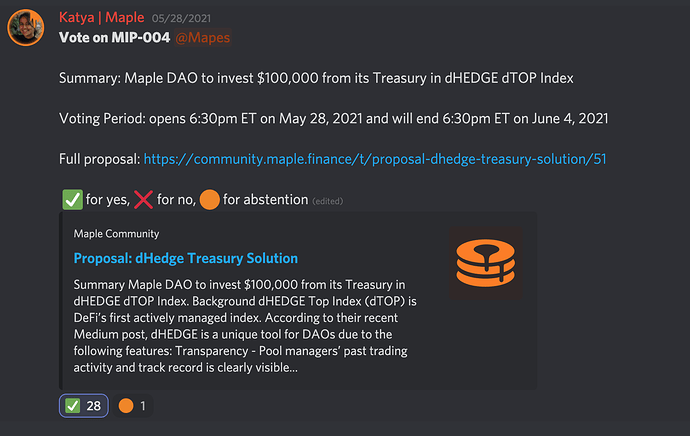

Maple DAO to invest $100,000 from its Treasury in dHEDGE dTOP Index.

Background

dHEDGE Top Index (dTOP) is DeFi’s first actively managed index. According to their recent Medium post, dHEDGE is a unique tool for DAOs due to the following features:

Transparency - Pool managers’ past trading activity and track record is clearly visible

Self Custody - Investors keep custody and control over their positions in the pools, they can withdraw whenever they see fit and not have to abide by anyone’s schedule

Competitive Performance - Managers on dHEDGE are automatically analyzed across multiple metrics. Investors can allocate capital to pools on performance, risk, strategy and other categories

Receive performance mining reward - For participation in dHEDGE pools, investors can earn extra rewards in DHT tokens, currently around 15% APY

Multi-sig capability - DAO’s can manage dHEDGE investments using multi-sig through the dHEDGE app on Gnosis Safe

Motivation

After a successful initial token distribution in April, the Maple DAO currently has funds available for investment in the Treasury. By committing $100,000 USDC to the dHEDGE dTOP Index, Maple would be able to earn interest on a portion of its Treasury and benefit from the features outlined above. This proposal is aligned with Maple’s mission of supporting the DeFi ecosystem & enables us to build partnerships with DAOs whose values align with our own. We see the potential for Maple to also be used as a treasury management solution for DAOs to deposit liquidity in future pools.

For Position

Maple DAO should invest $100,000 USDC of its Treasury into the dHEDGE dTOP Index.

Against Position

Maple DAO should NOT invest $100,000 USDC of its Treasury into the dHEDGE dTOP Index.

Author: Katya Ternopolska

Date Created: 05/27/2021

Discussion: Maple

Maple Improvement Proposal: MIP-004